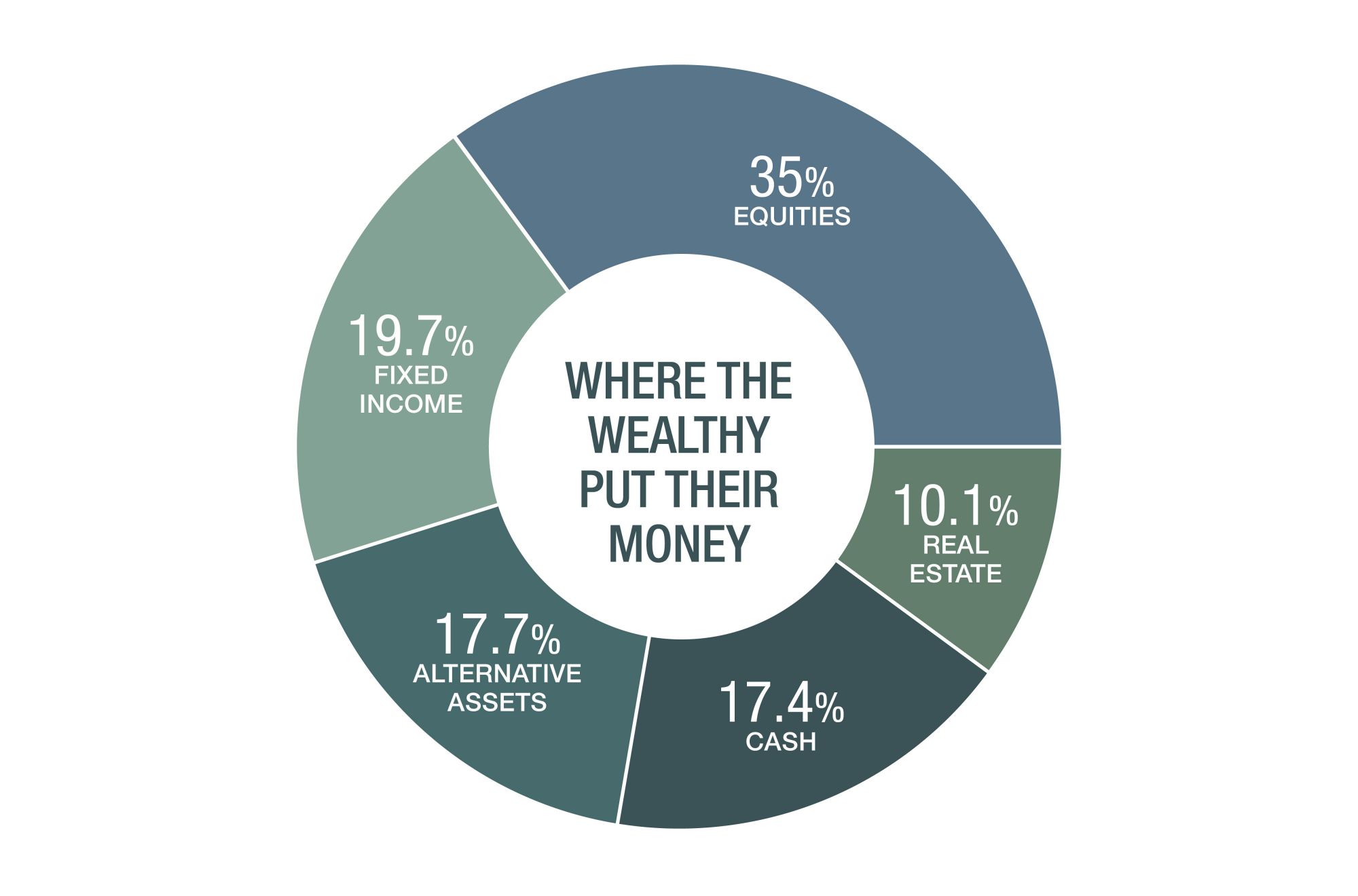

Large allocations to alternative assets and cash are hallmarks of the investment portfolios of the ultra-wealthy

After a good year for investments in 2017, last year was ugly. And while the portfolios of the ultra-rich do not change significantly from year to year, what we have seen in 2018 is a growing bias towards cash and a continuation of the long-running trend away from bonds due to low interest rates.

It is too early to say what kinds of returns ultrahigh-net-worth individuals (UHNWIs) generated overall in 2018, but some public investment funds with similar allocations have earned low singledigit returns. The US$350 billion California Public Employees’ Retirement System, for example, generated 3.3 per cent on its investments, according to initial estimates—far below its 10-year average return of around 8 per cent.

Of course, investment decisions are not typically based on short-term outlooks and can be heavily influenced by the particular goals of the investor.

“The factors are widespread and quite individual,” says Adrian Zuercher, head of asset allocation for Asia Pacific at UBS Global Wealth Management Chief Investment Office. “The most common factors are legacy factors—leaving a financial legacy for the coming generations—and those require a longterm asset allocation. Other important factors are sustainability goals. Our UHNWIs are often heavily engaged in philanthropy and charity. Aligning their core values with their investment strategy is a major factor for many of our UHNWIs.”

The population of ultra-wealthy people—those with US$30 million or more, by some definitions—is growing quickly, with Asia generating new wealth more than any other region. According to Wealth-X, the collective net worth of Asia’s UHNWIs grew by more than a quarter in 2017 and the total global wealth of this group of super-rich folk is now around US$31.5 trillion.

See also: How Foundations In Asia Are Being Passed Down To The Next Generation